Who is Paying the Highest Property Taxes?

Who is Paying the Highest Property Taxes?

The average median property tax rate across the nation is 1.31 percent. That means a home owner with a home valued at $200,000, on average, pays an annual amount of $2,620 in property taxes, according to an analysis by CoreLogic’s data team.

CoreLogic calculated the median overall property tax rates nationally by state. Researchers took into account all taxing and collection entities. Take a look at the chart below to see how your state ranks.

Learn more here:

http://bit.ly/1SWqxuo

Search the Retax Blog

All Blog Posts

- Orangetown – An Old Settlement

- Property Taxes Set To Increase, But You Can Appeal

- Haverstraw, New York – Named For Its Grasslands

- Clarkstown – A Growing Area

- Rockland County – New York’s Smallest County

- Town Of Rye, New York – A Tranquil Part Of The World

- Pound Ridge, New York – A Quiet Haven

- Economist Predicts A Staggering 20% Loss To Real Estate Values In Coming Year

- Pelham, New York – An Easy Commute To New York City

- Ossining – A Town Formerly Known As Sing Sing

Get smart tips!

Subscribe to our newsletter.

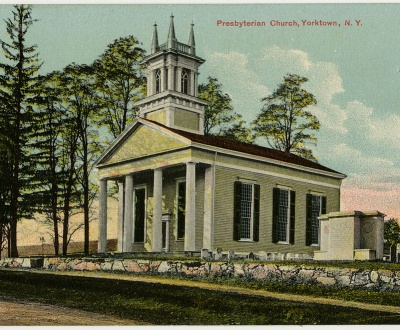

Yorktown enjoys a close proximity to one of the world’s largest metropolitan…

August 8, 2022 Mount Pleasant, New York is 28 miles square and…

The village of Irvington is located within the town of Greenburgh in…

Somers, New York was originally inhabited by the Kitchawanks of the Wappinger…

The national news media tells us that values of homes in the…

December 19, 2022 Rockland County is situated on the western side of…

Property taxes are an important source of revenue for city governments, but…

In my opinion, not until 2014 at the earliest. I say this…