What Does it Cost?

What Does it Cost?

There is absolutely NO CHARGE until we succeed in reducing your property taxes. Our fee of 60% of the first year’s reduction is payable AFTER you receive notification from the court that your assessment has been lowered.

Search the Retax Blog

All Blog Posts

- Orangetown – An Old Settlement

- Property Taxes Set To Increase, But You Can Appeal

- Haverstraw, New York – Named For Its Grasslands

- Clarkstown – A Growing Area

- Rockland County – New York’s Smallest County

- Town Of Rye, New York – A Tranquil Part Of The World

- Pound Ridge, New York – A Quiet Haven

- Economist Predicts A Staggering 20% Loss To Real Estate Values In Coming Year

- Pelham, New York – An Easy Commute To New York City

- Ossining – A Town Formerly Known As Sing Sing

Get smart tips!

Subscribe to our newsletter.

The New York Times has said that to set foot in…

The average median property tax rate across the nation is 1.31 percent.…

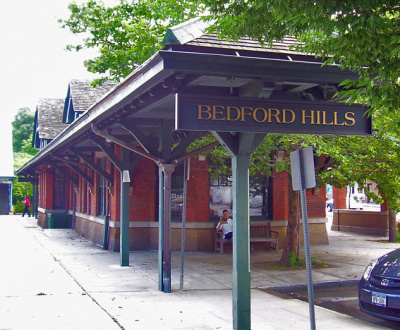

Bedford Hills is a quiet hamlet situated within Westchester County and is…

The United States economy has endured great economic upheaval in the past…

Incorporated in 1878, the village of South Nyack exists within the town…

Mount Kisco is located along a historic route littered with important sites…

Less than 1,000 people live in the village of Hillburn, New York,…

Hartsdale is a suburb located 20 miles north of New York City,…